The largest US natural gas-only LDC is Atmos Energy (NYSE:ATO). ATO serves 3 million clients in 1,400 areas in 8 states. Virginia, Kentucky, Tennessee, Mississippi, Louisiana, Texas, Nebraska, and Colorado. While political battlelines are being created over America’s continuing usage of natural gas, the electoral and regulatory climate in these states looks to favour ATO as a timely utility investment.

Atmos Energy: who?

Atmos Energy sells and distributes natural gas. Louisiana, West Texas, Mid-Tex, Mississippi, Colorado-Kansas, and Kentucky/Mid-States are the company’s six regulated natural gas utility businesses. ATO’s recent investors presentation map (shaded yellow) shows its service area.

Atmos Energy a “pure” natural gas LDC. Spire Inc (SR) and Southwest Gas Holdings (SWX) are “pure” gas utilities. Atmos Energy’s FY Sept 2022 gas sales breakdown was 64% residential, 34% commercial and industrial, and 2% other. Utility LDC, Pipeline and Storage, and Corporate comprise ATO. ATO, like many gas utilities, has a fiscal year that ends in September, with the first two quarters covering most of the high-use heating season.

Utility LDC services supplied 71% of FY2022 net income and Pipeline and Storage 29%. Texas has 5,700 intrastate pipeline miles and 5 natural gas storage facilities.

CFRA gave Atmos Energy a “A” SPGMI Quality Rating for 10-year profits and dividend growth. No non-water utility has an A+ rating. ATO’s rise should continue. ATO should earn $6.02 per share in FY2023, up from $5.60 in FY2022. FY2024 should be $6.41 and FY2025 $6.90.

Dividends should retain a 50% payout ratio at $2.72 last year, $2.92 this year, $3.20 in 2024, and $3.45 in 2025. Most experts expect EPS and dividends to climb 6%–8% over the next several years.

“Cancel Culture”

Natural gas has joined the new national pastime of “banning activities” including ICE automobile bans. West coast cities restrict natural gas for cooking and heating. At least 50 California, Oregon, and Washington cities have “electrification laws” banning gas in residential and commercial construction.

New York has banned natural gas appliances and heating systems in new buildings, including renovations, of less than 7 shops by 2026 and mandates all-electric heating and cooking in higher structures by 2030. The US government wants to restrict natural gas cooking burners to complete electrification.

Political views are fascinating. National Grid (NGG) and Consolidated Edison (ED) banned new natural gas hookups in downstate NY in 2019 owing to pipeline capacity and long-term supply concerns. The governor threatened to remove their company licenses unless the moratoriums were lifted, which they were, but now a ban on the same natural gas appliances is politically correct.

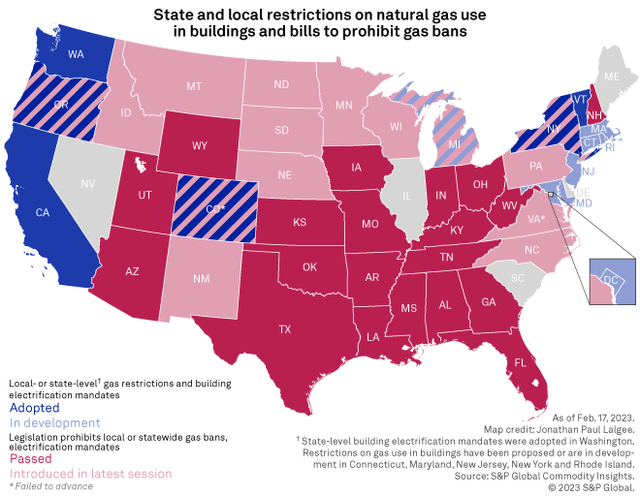

Why invest in a natural gas LDC given its poor political outlook? Simple—Atmos Energy’s service territory is superior than its coast-based competitors. Additionally, city- and county-wide natural gas prohibitions are facing legal challenges. The US Court of Appeals overturned municipal natural gas appliance bans. American Gas Association press release:

The U.S. Court of Appeals for the Ninth Circuit ruled on April 17, 2023, that the plain text and structure of the Energy Policy and Conservation Act (EPCA) preempts State and local regulations on natural gas appliance energy use, including Berkeley’s ordinance banning natural gas piping in new buildings. California Restaurant Association v. Berkeley, 21-16278

In February 2023, S&P produced a map illustrating states’ views on building electrification by law. Investors should look for states that prevent local natural gas building prohibitions.

European Union parliamentarians declared natural gas and nuclear electricity “green” or “sustainable” in July 2022. Natural gas used to generate power or heat or cool many dwellings is sustainable, however domestic gas appliances are not.

Ohio enacted “green” natural gas legislation in January 2023, which might help firms battling with ESG policies in the investing community.

Atmos Energy investors benefit from mid-America’s long-term use of natural gas for heating, cooking, and power generation.

Legal Framework

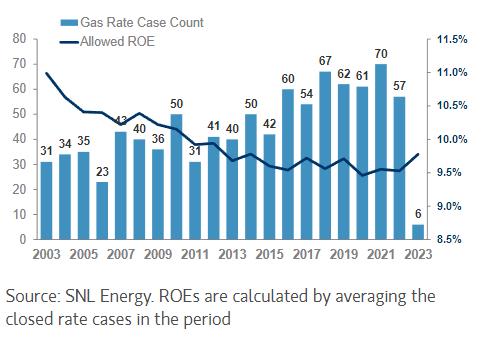

Each state regulates utility profitability and investor total returns. Retail investors must navigate the state-by-state utility profitability labyrinth. S&P’s Regulatory Research Associates RRA created a utility profitability supervision rating system decades ago.

RRA findings are not publicized and frequently many years old by the time I find a source. S&P occasionally updates states.

I keep an RRA ratings spreadsheet. Aug 2020 State Regulatory Rankings map. S&P disclosed the following RRA adjustments on their blog in November 2022, according to my records: Colorado, New Hampshire, Oklahoma, and North Carolina; Kentucky, Louisiana, New York, Texas, Connecticut, and Maryland downgraded.

Three major and three minor RRA state regulatory evaluation ratings are 1-1 for Above Average, 2-2 for Average, and 3-3 for Below Average.

I’ve updated RRA’s regulatory ratings for Atmos Energy’s service territory: Above Average 1-3 Tennessee; Average 2-1 Virginia, Mississippi, Nebraska, Colorado; Average 2-2 Kentucky, Louisiana; Average 2-3 Texas. Atmos Energy operates in jurisdictions with largely above-average regulatory ratings, which is good for investors. Texas is a large part of ATO’s service zone and made up 65% of FY2022 rate base.

Investors should be reassured by rising industry-wide regulatory ROE. Natural gas utility permitted ROE bottomed out in 2020 and has been slowly increasing since. With rising utility operating costs, financing expenses, and inflationary pressures, permitted ROE should rise.

Customer billings for natural gas LDC utilities include infrastructure costs and natural gas costs. LDCs like Atmos Energy achieve an authorized ROE on delivery investments but use pass-through accounting to bill and recuperate their real gas delivery costs.

ATO borrowed $2.2 billion to buy natural gas for consumers during Texas winter storm Uri in February 2021. ATO’s short-term credit profile improved as Texas regulators raised rates to recuperate this expenditure and pay off storm-related debt. ATO investors benefit.

Investment Thesis

Long-term ATO investors will benefit from a robust balance sheet and above-average rate base growth from highly visible and low-risk infrastructure safety and reliability capital improvements. Atmos Energy benefits from falling commodity gas prices from 2021.

Gas and electric utilities with gas-fired power facilities will lower rates. As natural gas prices fall this year, regulators will be less likely to reject fuel recovery petitions from customers. Due to low natural gas prices, utility rates are falling, reducing regulatory and political pressure. ATO’s regulatory business- and inventor-friendly service zone is also more protected against long-term natural gas use decreases than rivals.

Atmos Energy expects 6% to 8% annual profit growth till 2027. Since the distribution payout ratio has been around 50% for years, dividend growth in the 6% to 8% area is likely. ATO’s stock is costly, but its 2.5% cash dividend and 20.5x PE mean utility investors should expect an 8%+ total return.

During price weakness, I buy Atmos Energy. It complements my pure-LDC holdings in Missouri-based Spire Inc.’s convertible preferred equity units (OTCPK:SRCU) and preferred Series A (SR.PA). I held Southwest Gas Holdings before Mr. Icahn took over and wrecked its economic strategy.

I anticipate to buy SWX’s utility construction subsidiary Centuri when it starts trading and expect SWX to be acquired. Atmos Energy will replace SWX in my utility portfolio.